Deer Industry NZ has an active communications programme that aims to inform everyone involved or interested in deer farming about industry activities and other deer-related matters. Our communications include Deer Industry News, an A4 magazine published 6 times a year; DINZ eNews, an e-letter published 10-12 times a year; and DFA Stagline, a monthly e-letter published for the NZ Deer Farmers Association.

For more about these publications or to subscribe, click here >> All articles, media releases and publications produced by DINZ are searchable below. DFA Stagline is produced by the NZ Deer Farmers' Association and is available in the NZDFA section >>

Featured items

DINZ eNews

DINZ eNews

DINZ news in brief | Issue 108

18 April 2024

Korean healthy functional food market developing for New Zealand velvet | Putting New Zealand venison’s toes into the Korean market | Deer industry welcomes Government’s next steps for agricultural policy reform | The deer industry needs to continue its sustainability journey | Drench resistance should be front of mind for deer farmers | NZDFA Elections: vote required for NZDFA SAP | Countdown begins: under one month to go to Conference 2024 and more...

Venison demand may outstrip supply this year

18 April 2024

Demand for New Zealand venison may outstrip supply this year, with farmgate prices expect to be at, or slightly above, last year’s. While still early to get an indication of firm farmgate prices, some exporters are offering minimum contracts.

DINZ eNews

DINZ eNews

Deer farmers reminded: Be a mate, update NAIT

18 April 2024

OSPRI is calling for deer farmers to ‘Be a mate, update NAIT’, as weaners are starting to move off-farm. Recognising the challenges for deer farmers in complying with the National Animal Identification and Traceability (NAIT) programme, OSPRI is working alongside DINZ and NZDFA on solutions and support for farmers.

DINZ eNews

DINZ eNews

China velvet access: Constructive meetings held in China and NZ

18 April 2024

A flurry of “constructive and positive” meetings in New Zealand and China on the frozen velvet issue have revealed, “healthy relationships at all levels,” says DINZ executive chair Mandy Bell, with negotiating teams aiming for a timely resolution.

Deer Industry News Issue 121 March 2024

8 March 2024

Meet and Greet: Venison Vendor | Industry News | Innes Exits | New NZ venison brand ambassador in China: Xijin Wu | Deer to Succeed | Improving efficiencies in a venison system | Angular limb deformity | On farm GHG mitigation strategies | Reipe: BBQ leg fillet

Recent updates

DINZ eNews

DINZ eNews

14 March 2024

DINZ news in brief | Issue 107

Putting on the Ritz for the New Zealand deer industry in Shanghai | No single recipe for successful weaning, farming seminar hears | Transporting hinds or weaners? | Deer farmers’ environmental excellence in the spotlight | NZDFA needs YOU: committee nominations close 22 March | DINZ executive update: Strong interest in DINZ CEO position | Cenwynn’s off on parental leave | Register: 2024 Deer Industry Conference, Hawke’s Bay 8-9 May 2024

14 March 2024

DINZ eNews

DINZ eNews

14 March 2024

Freshwater farm plans next on the Coalition's to-do list

Having ticked off actions on its 100-day plan, the National-led coalition government’s attention will soon turn to rules around freshwater farm plans. Deer Industry NZ (DINZ) is pushing for measures allowing deer farmers to farm in a way that will protect the environment, be sensitive to local conditions and reduce the unnecessary burden of regulation and cost.

14 March 2024

DINZ eNews

DINZ eNews

14 March 2024

As the roar starts, hunters need to keep it clean

As the roar starts and trophy hunters are arriving in New Zealand, it’s a good time to remind them about cleaning equipment to avoid bringing in unwanted guests with them.

14 March 2024

DINZ eNews

DINZ eNews

14 March 2024

China: introducing trade advisor, Damon Paling

China trade advisor and former New Zealand trade commissioner Damon Paling, engaged by DINZ to assist with restoring access for New Zealand frozen velvet to China, is keeping his fingers and toes on the pulse of the negotiations. Careful and effective communication is key to their success, he says.

14 March 2024

DINZ eNews

DINZ eNews

16 February 2024

Planning for every scenario for frozen velvet access to China

New Zealand’s deer velvet exports to China increased by around $20 million in December as importers and exporters worked to deal with the changes to China’s import regulations for deer velvet. MPI/DINZ continue to work with Chinese counterparts on clear guidelines. Meanwhile industry planning is underway for every scenario.

16 February 2024

DINZ eNews

DINZ eNews

16 February 2024

This year’s stag sales “went very well”

This year’s December-January stag sales saw more interest in elk and wapiti and good prices being paid for quality sires, with three three-year-olds selling for over $100,000. Buyers were looking to improve genetics, among other highlights from the sales

16 February 2024

DINZ eNews

DINZ eNews

16 February 2024

Drought arrives in Marlborough – time for some “sacrificial hay”?

The current non-typical El Ninõ weather pattern has revealed the sting in its tail. Much of Marlborough and parts of northern North Canterbury are now in drought. It’s also extremely dry across the south of the North Island, inland South Canterbury and Central Otago. DINZ visited three Marlborough deer farmers in late January to see how they were coping.

16 February 2024

DINZ eNews

DINZ eNews

16 February 2024

Search for new Deer Industry NZ chief executive is underway

The search for the new DINZ CEO is well underway, following Innes Moffat’s resignation last month, updates DINZ executive chair Mandy Bell. Moffat has been praised by sector leaders for his work, which “has had a significant impact on many,” over the past two decades.

16 February 2024

DINZ eNews

DINZ eNews

16 February 2024

DINZ news in brief | Issue 106

Careful navigation ahead in the 2024 markets | DINZ looking into stag lameness | New online DINZ gateway for deer industry research | Shape the deer industry’s future: nominations open for NZDFA posts | Shutters ready: the 2024 Deer Industry Photo Comp is now open | Registrations open: 2024 Deer Industry Conference, Hawke’s Bay 8-9 May 2024

16 February 2024

DINZ eNews

DINZ eNews

19 December 2023

DINZ news in brief | Issue 105

A “day to remember” for six Chinese chefs visiting ‘The Ends of the Earth’ | A stunning day out at the Environmental Award field day | Fairlight Station first off the 2023-2024 stag sale blocks | It’s El Ninõ alright, but not as we know it | Research is investigating velvet’s immune function enhancement | Checking-in’ with North Island mates | New DINZ board observer: Camille Flack

19 December 2023

DINZ eNews

DINZ eNews

19 December 2023

Deer Industry NZ and MPI working with China on clear rules for New Zealand deer velvet imports

Deer Industry NZ (DINZ) and Ministry for Primary Industries are working with their Chinese counterparts to find and agree clear rules for the import of New Zealand deer velvet into China, after notification by MPI of changes to arrangements for 2024. While creating uncertainty in the short-term, long-term DINZ is seeking clearer, better and more secure access for both dried and frozen velvet.

19 December 2023

DINZ eNews

DINZ eNews

19 December 2023

Repeat performance at National Velvet Competition

John Ramsey (FJ Ramsey Investments Ltd) claimed his second consecutive big win at the New Zealand National Velvet and Trophy Antler competition, scooping both the Open Red and Champion awards. This was just one of many competitions held around the country this year.

19 December 2023

DINZ eNews

DINZ eNews

19 December 2023

New Government: keen to work with the rural sector

Deer Industry NZ (DINZ) is looking forward to working with the new coalition government now its work programme has been announced. Industry’s wish for rural policy that will, as DINZ chief executive Innes Moffat said last issue, “allow deer farmers to thrive,” seems to have been answered with a stronger voice for farmers.

19 December 2023

Deer Industry News

Deer Industry News

5 December 2023

Deer Industry News Issue 120 December 2023

Aligning science and strategy | Meet and Greet: Mike Ferrier | Long-term benefits anticipated | Nature's Superpower - what’s the story? | DINZ Board review: looking back and looking forward | The Legacy and Legend of Tim Wallis | Rego woes with MyOSPRI and NAIT tags | Optimism for Korean velvet market | Opportunities being sought for venison | Strong demand in Europe for New Zealand venison | New stress-less deer shed | Infectious lameness in deer | Tomorrow’s Deer progeny: adaptability to stressors

5 December 2023

News release

News release

24 November 2023

Supply chain adjustments for frozen velvet exports to China

China has signalled changes to its rules for imported velvet used in Traditional Chinese Medicine (TCM), meaning upcoming changes in New Zealand frozen velvet exports. Read on for further information.

24 November 2023

DINZ eNews

DINZ eNews

17 November 2023

DINZ news in brief | Issue 104

Silver Fern Farms held major customers conference at Anuga | Six Chinese chefs heading to ‘The Ends of the Earth’ | Deer industry very low user of antibiotics, study shows | Deer farmers to gather at environment award-winning Glen Dene | Velvetters: register in VelTrak and select your current vet clinic | Sports star joins PGG Wrightson’s deer team | Sir Tim Wallis farewelled in style in Wanaka | New DINZ board observer sought for 2024

17 November 2023

DINZ eNews

DINZ eNews

17 November 2023

What does the new Government have in store for us?

The new centre-right coalition, led by the National Party, means a probable slowdown in the pace of change for farmers, but not a reverse in the direction of travel, writes Deer Industry NZ (DINZ) chief executive Innes Moffat. DINZ wish list is for policy allowing deer farmers to thrive, celebrating good land stewardship and not condemning all to “death by a thousand consents.”

17 November 2023

DINZ eNews

DINZ eNews

17 November 2023

First two New Zealand velvet health food claims approved in Korea

The first two health functional food claims, with extracts using New Zealand velvet, have now been approved by Korea’s food safety authorities, aimed at improving prostate function and anti-fatigue. It is also the start of an exciting new era for New Zealand velvet in its top market.

17 November 2023

DINZ eNews

DINZ eNews

17 November 2023

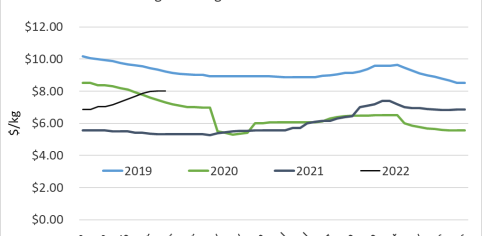

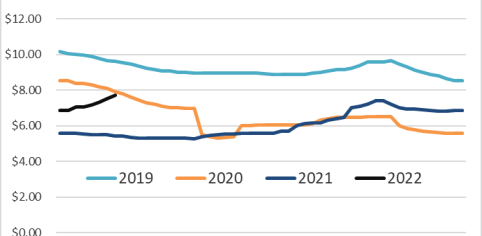

Strong demand for chilled venison continues in Europe, but late Spring impacts supply

Demand for chilled New Zealand venison in Europe continues to be strong, marketers are reporting, supporting venison contract prices up to $10.50 per kg. Slow growth has limited supplies this Spring, meaning some customers have missed out on volumes.

17 November 2023

DINZ eNews

DINZ eNews

19 October 2023

DINZ news in brief | Issue 103

Input needed: biodiversity credits consultation | New deer research strategy on the way for 2024 | Ladley hits the ground running on industry capability | Where do our leaders stand? | New support for NZDFA branches | Deer farmers getting prepared for long, hot and dry El Ninõ summer | Drinking water suppliers need to get registered | Velvetters reminded to check details are correct in VelTrak

19 October 2023

DINZ eNews

DINZ eNews

19 October 2023

“We’re ready for the challenge,” declares DINZ chair

A new Government is incoming, after the electorate decided on a National-led coalition on Saturday night. After all the recent changes to Deer Industry NZ (DINZ), the industry is ready for whatever challenges come its way, DINZ chair Mandy Bell told deer industry leaders last week.

19 October 2023

DINZ eNews

DINZ eNews

19 October 2023

Sir Tim Wallis: a big totara has fallen in the deer industry

One of this industry’s founding fathers, Sir Timothy William Wallis, died in Wanaka on Tuesday 17 October, aged 85. The crash of the mighty tree will be heard around the deer farming world, after a life, well lived. His incredible contribution from the early days of live-capture, to the first deer farms and his entrepreneurial business acumen laid the ground for today’s industry.

19 October 2023

DINZ eNews

DINZ eNews

19 October 2023

Individual value chains in New Zealand venison’s future

The future for New Zealand venison involves a series of individual value chains with groups of farmers supplying animals targeting different niches, DINZ board member and First Light group manager director Gerard Hickey predicts. He showed the deer industry leaders how venison marketers’ efforts to diversify markets are paying off.

19 October 2023

DINZ eNews

DINZ eNews

19 October 2023

Complex 2023-2024 velvet season ahead

The 2023-2024 velvetting season has just started. It’s likely to be complex, but there are still positives, DINZ markets manager Rhys Griffiths warned the NZ Deer Farmers Association branch chairs. Last season was “hard work” but still finished with exports worth over $100 million.

19 October 2023

Deer Industry News

Deer Industry News

28 September 2023

Deer Industry News Issue 119 September 2023

Meet and Greet: Sarah O'Connell | Provelco changes and more | Fresh faces for DINZ | Venison: The USA | Wetlands a win-win | The flow-on of freshwater farm plans | Turning the tide on nutrient losses | Next Generation | Flying the flag for deer farming | Cyclone Gabrielle recovery | What motivates us to farm deer? | Velvetting: lessons learned | Water-fed research

28 September 2023

DINZ eNews

DINZ eNews

14 September 2023

John Ladley “pulling on an old jersey” for DINZ industry capability

New DINZ industry capability manager John Ladely is “pulling on an old jersey, that’s been renovated a wee bit” for his new role, focused on ensuring the deer industry has the best skills and knowledge to move into the future. He’s “passionate about supporting farmers and ensuring organisations can deliver positive outcomes for growers.”

14 September 2023

DINZ eNews

DINZ eNews

14 September 2023

Flaming start to game season for NZ Venison BBQ Week

NZ Venison BBQ Week got off to a flaming start in the UK last week, with activities taking place around the world to raise awareness of premium New Zealand venison. It took place against strong demand and firmer prices for chilled venison says Deer Industry NZ chief executive Innes Moffat.

14 September 2023

DINZ eNews

DINZ eNews

21 August 2023

DINZ news in brief | Issue 101

BBQ tongs at the ready for NZ Venison BBQ Week | Sharing views on deer farming in Wanaka | Exchanging tips on managing lameness in deer | Elk-infused Next Generation gathering | Velvetting study wins funding from China | DINZ moves and people

21 August 2023

21 August 2023

DINZ news in brief | Issue 102

BBQ tongs at the ready for NZ Venison BBQ Week | Sharing views on deer farming in Wanaka | Exchanging tips on managing lameness in deer | Elk-infused Next Generation gathering | Velvetting study wins funding from China | DINZ moves and people

21 August 2023

DINZ eNews

DINZ eNews

21 August 2023

Improved venison prices holding up, despite tough global conditions

Shipments of chilled venison will soon be heading off to supply the European game season, Exporting companies are reporting good demand for venison this year, even though prices for other proteins have softened.

21 August 2023

DINZ eNews

DINZ eNews

21 August 2023

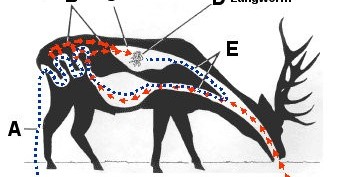

Tannin-rich feeds confirmed to reduce methane in deer

Research in Scotland has identified tannin-rich heather as a methane reducer in wild deer, pointing the way to new greenhouse gas research for New Zealand’s farmed deer. The Scottish research is highlighted in a deer-specific methane mitigation literature review, just completed as part of the DINZ/AgResearch-funded Science2Success programme.

21 August 2023

DINZ eNews

DINZ eNews

21 July 2023

DINZ news in brief | Issue 100

Pan-ready cuts in demand from New Zealand venison’s foodservice customers | Thermal comfort a “continued focus area” for MPI | Increased risk of leptospirosis flagged | Marking our 100th | DINZ moves and people

21 July 2023

DINZ eNews

DINZ eNews

21 July 2023

Government must work with rural sector on common-sense stock exclusion rules

Government must enable farmers to adopt a flexible, common-sense approach to managing the exclusion of beef cattle and deer from waterways, says Beef + Lamb NZ, Federated Farmers and Deer Industry NZ. The organisations’ joint submission on the latest low-slope consultation calls on it to work with the sector on a fair and workable solution.

21 July 2023

DINZ eNews

DINZ eNews

21 July 2023

Confidence returning with strong market for high-BV hinds

This year’s hind sales are underway with good prices being achieved for good quality animals, DINZ has noted. The strong market for high-BV animals indicates people are, “particularly looking for hinds that will provide weaners that will finish early for the venison markets, says PGG Wrightson deer agent Murray Coutts.

21 July 2023

DINZ eNews

DINZ eNews

21 July 2023

New Zealand venison gets boost from Sweden

New Zealand venison was on the menu last week at a special event in Stockholm. Prime Minister Chris Hipkins was among the high-ranking officials to sample it, in one of many opportunities taken this European game season to present New Zealand venison existing and new customers.

21 July 2023

13 July 2023

Notification: Increased risk of leptospirosis infections in animals

This notification is to inform you and the organisations that you represent that there is a likelihood of an increased risk of leptospirosis infections in animals and humans.

13 July 2023

DINZ eNews

DINZ eNews

15 June 2023

DINZ news in brief | Issue 99

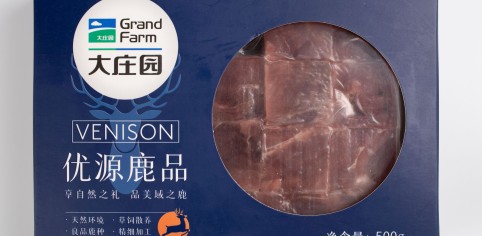

Alliance/Grand Farms venison range attracting attention in China | Census shows changes in deer numbers | New deer farmer’s voice on DINZ board | DINZ staff updates | Introducing: Helen Montgomery

15 June 2023

DINZ eNews

DINZ eNews

15 June 2023

DINZ will work on equitable reductions to agricultural GHG emissions

DINZ will work with the pastoral sector partners, Māori and government on equitable reductions to agricultural greenhouse gas emissions, writes Deer Industry NZ chief executive Innes Moffat. DINZ position remains that agriculture must be kept out of the ETS and that NZ agribusinesses should take steps to reduce GHG emissions.

15 June 2023

DINZ eNews

DINZ eNews

15 June 2023

Freshwater farm plans for farmers in Southland and Waikato

Deer farmers will have 18 months to get a freshwater farm plan (FWFP) when their region is ‘turned on’ under new regulations passed through Parliament last week. New regulations will come into force on 1 August 2023, with farmers in Southland and Waikato the first to experience roll-out from that date.

15 June 2023

DINZ eNews

DINZ eNews

15 June 2023

US restaurateurs given a taste of New Zealand Venison

US restaurateurs were given a taste of New Zealand venison last month at their annual National Restaurant Association (NRA) show in Chicago. All of the New Zealand venison marketing companies collaborated in a stand, which gave a platform to showcase New Zealand products and meet potential new clients.

15 June 2023

Deer Industry News

Deer Industry News

15 June 2023

Deer Industry News Issue 118 June 2023

Positive steps in China | Cyclone Gabrielle | Special report: Conference 2023 | NZDFA AGM | The Falconers of Clachanburn: making the best of their land and animals | NZ Velvet awaits functional claim | Step-by-step recovery | Finger-tip tech to keep on track | Taking care of parasite control | Great people and good times | MSD/Allflex photo competition results

15 June 2023

DINZ eNews

DINZ eNews

19 May 2023

DINZ news in brief | Issue 98

2023 Deer Industry Conference a success | Pushing New Zealand velvet boundaries in Asia | Marketers’ activities improving venison returns | ”Hunting hipsters” in the sights in the US | Study shows real impact of deer farms’ on stream health | Deer velvet does help reduce tiredness, study proves | Award winners

19 May 2023

DINZ eNews

DINZ eNews

19 May 2023

DINZ chair: Primary conversation has to be about setting up for the future

The deer industry is “setting up for the future,” chair Mandy Bell told delegates at the 2023 Deer Industry Conference in Ashburton last week. That has to be the industry’s “primary conversation” and is involving a refocus for its industry-good organisation, she writes in a Letter from the Chair.

19 May 2023

DINZ eNews

DINZ eNews

19 May 2023

Flood recovery: “She was a pretty hectic day”, recalls Darryl Butterick

Flood recovery, following the devastating Canterbury floods in 2021 was the topic of the conference field day held at Darryl and Lynne Butterick’s property in 11 May. Lessons have been learned for future adverse events, around 75 attendees learned.

19 May 2023

DINZ eNews

DINZ eNews

19 May 2023

DINZ restructures to be ‘fit-for-purpose’

DINZ is changing to meet the new environment it is facing and to create a fit-for-purpose industry-good organisation to serve the sector, DINZ chief executive Innes Moffat told the Deer Industry Conference audience. He warned of “disruptions to some of the services provided by DINZ,” while everything is being bedded in.

19 May 2023

DINZ eNews

DINZ eNews

20 April 2023

DINZ news in brief | Issue 97

DINZ working on changes to lead a confident industry | Waiting on a Government HWEN decision | Weaner transport reminder | Link to B+LNZ campaign | New technical guidance for winter grazing | Post-cyclone recovery continues | Hawke’s Bay event to focus on ‘Farming for a successful future’ | Vote for your favourite deer industry photo | Recipe: Lemongrass venison steak and avocado summer rolls | Food for thought, 2023 Deer Industry Conference

20 April 2023

DINZ eNews

DINZ eNews

20 April 2023

Future appears bright for New Zealand velvet in Korea

The future appears bright for the success of New Zealand’s velvet exports into Korea. Two Korean agency representatives who work for DINZ shared their market insights during a recent visit to New Zealand.

20 April 2023

DINZ eNews

DINZ eNews

20 April 2023

Meeting in the middle over weaners

Deer breeders and finishers are meeting in the middle in their weaner negotiations, with breeders coming off the back of two hard years, now connecting with a softer finishing market. There’s an “unusual” variation between North Island and South Island prices.

20 April 2023

DINZ eNews

DINZ eNews

20 April 2023

This year’s deer weaner prices more than competitive

This season’s deer weaner market suggests prices are falling between $4.50-$5.20 per kg carcase weight. These are “more than competitive with sheep and heading towards the $5.50/kg or more farm consultant Wayne Allan has calculated breeders need to out-compete other land uses.

20 April 2023

Deer Industry News

Deer Industry News

31 March 2023

Deer Industry News Issue 117 March 2023

Cyclone Gabrielle aftermath: the first steps of recovery | Gearing up for Winter: management tips and advice for a smooth transition to winter | DINZ Vision 2022 - 2027: The priorities, costs and benefits of the new strategy 'Thive with Passion' | Figured Thinking: Gross margin analyses - The opportunities and prospects for venison farmers

31 March 2023

DINZ eNews

DINZ eNews

16 March 2023

DINZ news in brief | Issue 96

“Robust discussions” around new Deer Industry Strategy | China reactivating for New Zealand velvet | Deer Industry Conference 2023 moves to Ashburton | Ready to shape the sector’s future? Stand up for deer industry leadership | Recipe: Thai venison larb salad

16 March 2023

DINZ eNews

DINZ eNews

16 March 2023

Deer milk improves muscle mass and physical performance, study finds

A recent New Zealand clinical trial found regularly consuming deer milk improves the nutritional status, muscle mass and physical performance of women aged 65 and over.

16 March 2023

DINZ eNews

DINZ eNews

16 March 2023

Interested in becoming a NVSB-certified deer velvetter?

Deer farmers and their employees may apply to be certified to remove velvet antler from their stags under a programme run by the National Velvet Standards Body (NVSB). The programme is quite rigorous, taking about six months to complete. Now’s a good time to apply for those wanting to be certified to remove velvet next season.

16 March 2023

16 March 2023

World’s deer community to come to Dunedin in 2026

For the second time in 43 years, Dunedin will host the International Deer Biology Congress in 2026, attracting up to 500 cervid researchers and professionals to the ‘unofficial wildlife capital of New Zealand’.

16 March 2023

DINZ eNews

DINZ eNews

16 March 2023

New regulations to keep dams safe

New regulations for dam safety come into effect from 13 May 2024.

16 March 2023

DINZ eNews

DINZ eNews

16 March 2023

Changes to farm environmental management

Cabinet is expected to release its final recommendation on the farm-level agricultural emissions pricing plan by mid-March. But it’s only one of the environmental management changes deer farmers are having to grapple with and work out how to implement in reality on-farm, according to DINZ environmental stewardship manager Sara Elmes.

16 March 2023

DINZ eNews

DINZ eNews

16 March 2023

Deer farmers helping cyclone-affected deer farmers

Cyclone Gabrielle has been a record breaker for all the wrong reasons and its impact has been felt across the North Island. The tight-knit deer farming community has rallied to the cause, raising over $117,000 at an auction last night and providing practical support, to help their badly affected peers in areas impacted heavily last month.

16 March 2023

DINZ eNews

DINZ eNews

16 March 2023

Aiming for $10 for venison this Spring

A spring peak of $10/kg is being indicated by some of the venison marketers, who are all working hard in the tri-market development model to create stable demand for venison. This was among the deer farming issues raised in meetings between the DINZ Board and the NZDFA’s South Canterbury & North Otago and Canterbury West Coast

16 March 2023

DINZ eNews

DINZ eNews

17 February 2023

DINZ news in brief | Issue 95

Export returns up for velvet and venison in 2021/2022 | Mixed start for velvet season | Smart sensors piloted in PGG Wrightson deer velvet freezers | Venison buyers return to NZ | New Zealand venison receives top award in China | VelTrak™ password change approaching | New industry research strategy for GHG mitigation underway | New DINZ Board observer appointed | Call for deer farmers to help DINZ showcase environmental work

17 February 2023

DINZ eNews

DINZ eNews

17 February 2023

New DINZ strategy to ‘Thrive with Passion’

The deer industry is discussing the new strategy to guide Deer Industry NZ (DINZ)’s work over the coming five years. ‘Thrive with Passion’, has the ambitious vision to shape the deer industry for a changing world. DINZ is working on detailed plans for delivery of the priority projects and calling for feedback.

17 February 2023

DINZ eNews

DINZ eNews

17 February 2023

DINZ strategy: deer farmers keen “to get it right”

Deer farmers are urged to have their say on the new strategy by deer farming leader Justin Stevens. He has been hearing “plenty of passion” but also frustration, “disappointment and disillusionment too” from deer farmers about what has happened in the past. “That’s what the strategy’s all about, he says. “Now is the time for deer farmers to have their say.”

17 February 2023

DINZ eNews

DINZ eNews

17 February 2023

What will greenhouse gas levies mean for deer farmers?

In two years, all deer farmers will be paying greenhouse gas levies. Details of the programme will be decided by the Cabinet in March. But the amount farmers will pay will likely be much less than was proposed by the government a year ago. “The direction of travel is looking much more promising,” says DINZ chair Mandy Bell.

17 February 2023

17 February 2023

Venison prospects continue to improve

Strong interest from visiting European buyers signals further improvement in venison prices in 2023, reports DINZ venison marketing manager Nick Taylor. Venison marketing companies are hosting buyers from Europe and the US to plan deliveries and promotions for the coming year.

17 February 2023

DINZ eNews

DINZ eNews

17 February 2023

Cyclone Gabrielle: Government announces initial $4 million support package

Government has made $4 million available to help farmers, growers, whenua, Māori owners and rural communities in the areas affected by Cyclone Gabrielle to mobilise and co-ordinate recovery efforts. MPI is working with DINZ to help and assess what else might be needed. Deer farmers need to note OSPRI/NAIT changes and where support is available.

17 February 2023

DINZ eNews

DINZ eNews

17 February 2023

Quality over weight trend for velvet

Recent velvet competitions and sire stag sales have showcased the growing trend for quality over weight when it comes to New Zealand deer velvet, says judge and PGG Wrightson national deer and velvet manager Tony Cochrane.

17 February 2023

21 December 2022

Deer industry acknowledges government’s climate report

Deer Industry NZ (DINZ) is cautiously optimistic that the emissions pricing system being developed by government will help reduce farm greenhouse gas (GHG) emissions without putting hill and high country farmers under undue financial pressure.

21 December 2022

DINZ eNews

DINZ eNews

16 December 2022

DINZ news in brief | Issue 94

High value cuts finding their place in the difficult European market | Ultimate Kiwi range a hit in New Zealand supermarkets | New Zealand venison recipes now in te reo Māori | Solid progress made on New Zealand velvet in China | DINZ upgrades working relationship with KGC | DINZ secures MPI funding to help with farm planning | New Deer Industry News editor Lynda Gray “up for the challenge”

16 December 2022

DINZ eNews

DINZ eNews

16 December 2022

Complex start for the velvet season

Velvet exporters are facing one of the most complicated starts to the season DINZ manager markets Rhys Griffiths has witnessed, particularly in China. “Velvet consumption is generally trending in the right direction, but it’s just taking its time to move through the supply chain,” he reports.

16 December 2022

DINZ eNews

DINZ eNews

16 December 2022

Venison exporters mindful of need to lift farmgate prices

Venison exporters, confident in the outlook for next year, are mindful of the need to lift farmgate prices of as they negotiate 2023 sales contracts. With a good game season behind them and reported continuation of strong demand, despite European uncertainty, the future is looking positive.

16 December 2022

DINZ eNews

DINZ eNews

16 December 2022

New DINZ strategy to accelerate industry recovery and confidence

The Deer Industry New Zealand Board has just released a new strategy to guide its activities from 2023 to 2027 to speed up the industry recovery and build confidence in a sustainable and profitable future. “Thriving with passion,” is the vision for the sector, Deer Industry NZ CEO Innes Moffat writes.

16 December 2022

Deer Industry News

Deer Industry News

8 December 2022

Deer Industry News Issue 116 December 2022

Facing fifty: Invermay celebrates half century in deer | Game Season Recap: full steam ahead for game season in Europe but cost of living concerns linger | Elworthy Award: Dr Lee and film crew come to Forest Road Farm to celebrate premier award win | Maximising Venison: three farms show how terminal sires fit their system and boost carcass weights

8 December 2022

News release

News release

17 November 2022

Emissions pricing: Deer farmers' voices needed

As Deer Industry NZ (DINZ) prepares a submission on the government’s new farm-level pricing scheme for agricultural greenhouse gas (GHG) emissions, deer farmers’ voices are needed. DINZ chair Mandy Bell says there are opportunities to work with other sectors and government to “ensure the inevitable cost of GHG pricing is manageable”, that those with no way to sequester or mitigate are provided some relief, “and that decisions about the farming industry are taken by people with experience on and knowledge of the sector.”

17 November 2022

News release

News release

17 November 2022

Nature’s Superpower™: Leap to a new dimension for deer products

New Zealand deer products are taking a leap to a new dimension with the roll out of a new way of telling the deer farming story. Nature’s Superpower™ has been developed by DINZ to help the sector tell a consistent story about New Zealand’s venison and velvet products. Canterbury deer farmer Graham Peck has welcomed the “very professional” initiative.

17 November 2022

News release

News release

17 November 2022

Europe is open for venison business again

Europe is open for venison business again. Sales personnel are just returning from their first market visits for a couple of years. Duncan NZ executive chairman Andy Duncan reports he found Europe “is open and folks are getting on with business …”

17 November 2022

DINZ eNews

DINZ eNews

17 November 2022

DINZ news in brief | Issue 93

Korean customers first to be introduced to Nature’s Superpower | Two sides to the velvet market | New Zealand foodwriters get a taste of venison | From the deer science archives: diseases that now cause less dis-ease | On-farm biodiversity: “Just start” | VelTrak: Don’t use the old blue tags | New summer intern for DINZ: Katie Preston | Looking for governance experience? DINZ seeking 2023 observer | Recipe: Venison Sausage Roll Wreath

17 November 2022

News release

News release

20 October 2022

GHG pricing options must improve

Two weeks have passed since the New Zealand government opened consultation on its proposals for this country’s new world-first, farm-level emissions pricing system. DINZ has “deep concern” about the proposals’ impact on deer farming viability as they stand.

20 October 2022

News release

News release

20 October 2022

GHG pricing: DINZ getting down to detail

Transitional arrangements to protect sectors without mitigations is a part of the government’s farm-level emissions pricing proposal that is being worked on by the DINZ team going through the mass of detail Deer farming leaders were updated last week at the DFA Branch Chairs meeting in Wellington.

20 October 2022

News release

News release

20 October 2022

Republic of Korea: Positive message for NZ velvet

Consumption of New Zealand velvet will continue to increase in the medium-term, according to DINZ market manager, Rhys Griffiths. He brought the positive message from DINZ’first post-Covid market visit to South Korea.

20 October 2022

News release

News release

20 October 2022

US: Keeping three legs on the venison stool

Good progress is being made on growth in the US market and plans have firmed up for a $5 million investment over the next three years that will keep “three legs on the venison stool,” according to DINZ board member and First Light group managing director Gerard Hickey.

20 October 2022

DINZ eNews

DINZ eNews

20 October 2022

DINZ news in brief | Issue 92

China: “work coming to fruition” | Companies stick with Cervena® | Low methane animals produce same meat quality | DINZ keeping alert for CWD | Invermay 50th – just like the old days! | Industry financial contribution key to government funding | Ian Walker farewelled in Hawke’s Bay | Winner of the 2022 Deer Industry Award is “a true doer” | Barry Mackintosh wins 2022 Matuschka Award | New NZDFA Life Members: Paddy and Barbara Boyd | Phil Stewart, highly commended for science writing | Recipe: Venison bacon chilli | Events

20 October 2022

Deer Industry News

Deer Industry News

13 October 2022

Deer Industry News Issue 115 Oct-Nov 2022

Next Generation: Striding to the future | Tech Workshop: Venison and velvet market updates; winter feeding; genetics progress | Game season: Berlin embassy hosts NZ venison show; fine food days; strong chilled demand | He Waka Eke Noa: How DINZ is putting the case for the deer industry while govt response awaited

13 October 2022

Media release

Media release

11 October 2022

Deer industry needs reassurance on impacts of greenhouse gas proposal

Deer Industry New Zealand recognises that the government proposes to adopt a system for pricing agricultural emissions outside the New Zealand Emissions Trading Scheme (NZETS).

11 October 2022

Media release

Media release

22 September 2022

Revised deer welfare code “positive”

Deer Industry NZ says a draft of an updated Deer Code of Welfare, released on Friday for public comment, is a positive forward-looking document.

22 September 2022

News release

News release

22 September 2022

Everything is on the table, says DINZ chair

Since being elected chair of Deer Industry NZ (DINZ) in July, Mandy Bell has been busy talking with farmers, sister organisations and the DINZ team on the breadth of issues facing deer farming in New Zealand. She outlines the DINZ Board’s immediate priorities.

22 September 2022

22 September 2022

P2P springboard to much bigger industry

Minister of Agriculture, Hon Damien O’Connor, has challenged the deer industry to grow to become a billion-dollar industry. He was speaking at an event held at Parliament last week to celebrate the success of the Passion2Profit programme, which has just concluded.

22 September 2022

News release

News release

22 September 2022

Luxury deer leather for Bergdorf Goodman

Luxury deer nappa leather bags from Wellington bag designer Yu Mei will be launched at New York’s Bergdorf Goodman luxury store this November, following great feedback from international retailers. Yu Mei founder Jessie Wong is a big fan of New Zealand deer leather and says she’ll be championing it.

22 September 2022

DINZ eNews

DINZ eNews

22 September 2022

DINZ news in brief | Issue 91

P2P “incredibly important” cornerstone, says Moffat | P2P “achieved much, did not have perfect run” | Velvetters reminded of obligations ahead of new season | Putting faces to the deer science | DINZ working with MPI on FMD readiness | Deer farmers urged to check parasite protocols | Deer farmers/vets encouraged to submit on new Deer Code of Welfare | Cervena Licence renewal | NZ Venison BBQ Week | Recipe: Bacon-wrapped venison bites

22 September 2022

13 September 2022

Deer programme celebrated after 7 years

Passion2Profit, a Primary Growth Partnership programme funded 50/50 by the Ministry for Primary Industries and Deer Industry NZ, has resulted in the development of major new markets for NZ farm-raised venison. Farms are more productive and even more environmentally sustainable than have always been. In 2022, after seven years and an investment of $14 million, the programme ended.

13 September 2022

News release

News release

25 August 2022

2022 Velvet Season Tagging Reminders

There are a few things farmers can do to help the tagging process this season.

25 August 2022

News release

News release

25 August 2022

Chilled prices up, seafreight puts the brakes on

Prices are up, demand is good, shipping is a real problem: summarises prospects for the coming chilled season. The recovery of venison prices continues and venison companies have been sharing their spring season expectations with their suppliers. DINZ understands these are well up on last year, but with sea freight risks shortening the export window.

25 August 2022

News release

News release

25 August 2022

Pivot to US retail for venison showing signs of success

The pivot to retail in the United States is having positive results for marketers. All marketing companies report significant increases in the volumes being sold through retail in the US. The Lamb Company reports “very encouraging” interest from US consumers which points to the future potential of this market for the industry.

25 August 2022

News release

News release

25 August 2022

New NZ velvet products launched in Korea

Eight out of 12 new healthy food products launched in South Korea over the past six months used, and have been marketed as containing, New Zealand velvet. But, New Zealand has competition at its heels and must not become complacent.

25 August 2022

News release

News release

25 August 2022

Deer farmers getting to ‘Know Your Number’

Peel Forest Estate’s Mark Tapley says attending a DINZ “Know Your Number” workshop has made things a lot clearer. It was very helpful in getting his head around what is involved, and what it might mean for his operation when greenhouse gas (GHG) pricing is introduced in 2025. All participants leave knowing their greenhouse gas emissions number.

25 August 2022

DINZ eNews

DINZ eNews

25 August 2022

DINZ news in brief | Issue 90

Tightened biosecurity precautions for FMD | VelTrak 2.0 on the road | VelTrak tags on their way to vets now | Show us your best venison recipe! | P2P transition in progress | Deer farmers flock to national technical workshop | Deer farmers called to share how they unwind | Nominations open for 2022 deer industry awards | and more.

25 August 2022

News release

News release

21 July 2022

Mandy Bell elected as new DINZ chair

Central Otago deer farmer and veterinarian Amanda (Mandy) Bell was elected earlier this month as chair of the Deer Industry NZ (DINZ) board. Gerard Hickey, group managing director of First Light Foods, has been elected deputy chair. Under Bell’s leadership, DINZ will continue to support producers with policy advocacy, where needed, using the industry’s environmental leadership to build sales of venison and velvet.

21 July 2022

News release

News release

21 July 2022

DINZ pushes back on SNA definition for indigenous biodiversity

DINZ is putting deer farmers’ voices forward on the latest draft of the National Policy Standard (NPS) on Indigenous Biodiversity. The description of Significant Natural Areas (SNAs) is of most significance for deer farmers, says DINZ environmental stewardship manager Sara Elmes.

21 July 2022

News release

News release

21 July 2022

Deer 101 for central and local government essential

"Deer 101", run by DINZ and DFA for staff from regional council and central government, is “essential and ongoing” activity for the deer sector dealing with new regulations from freshwater through carbon and biodiversity to welfare. They are being run so government staff “know what good practice on a deer farm looks like,” says Lindsay Fung.

21 July 2022

DINZ eNews

DINZ eNews

21 July 2022

DINZ news in brief | Issue 89

Fresh faces on the DINZ Board | Nothing like personal contact | NZ-EU FTA gives certainty to deer exports | Benefits of eating pasture-raised meat established | Using eASD? It’s moving to MyOSPRI this weekend | 65 kg carcases in spring: easy? | Stay vigilant for FMD | From the archives – Reproduction and hind longevity | Know a certificate or diploma agriculture student who wants to learn more about the deer industry? | Events

21 July 2022

Media release

Media release

14 July 2022

New deer industry chair

Central Otago deer farmer and veterinarian Amanda (Mandy) Bell has been elected chair of the Deer Industry NZ (DINZ) board. Gerard Hickey, group managing director of First Light Foods, has been elected deputy chair.

14 July 2022

Deer Industry News

Deer Industry News

11 July 2022

Deer Industry News Issue 114 Jul-Sep 2022

Deer 101 day: Otago MPI & Regional Council staff get first-hand experience of deer farming | DINZ hits the road: More than 300 farmers attend successful series of DINZ road trips covering both islands | Netherdale era ending: Leading stud calls time after four decades building quality of NZ antler genetics

11 July 2022

News release

News release

17 June 2022

Better venison prices are top DINZ priority

We couldn’t bring you to Wellington, so we brought Wellington to you. DINZ’s top priority is to assist with the recovery in venison prices, DINZ chief executive Innes Moffat reports from the six-stop 2022 DINZ Road Trip, a shortened version of the annual conference.

17 June 2022

News release

News release

17 June 2022

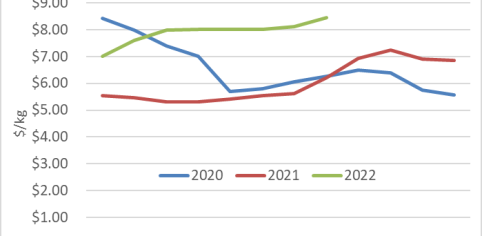

Venison prices on track

Venison has been hit hardest by Covid-19 and when will prices fully recover? That was the main topic of the DINZ Board Q&A session in Palmerston North, chaired by Dr Ian Walker. Recovery is happening, but the work of lifting sustainably from commodity markets needs to continue, deer farmers heard.

17 June 2022

News release

News release

17 June 2022

First dried velvet exported to China

PGG Wrightson exported the first ever dry velvet to China earlier this month – a sign of the changing times for New Zealand deer velvet, which is targeting health food companies in the emerging market in a bid to increase value for farmers.

17 June 2022

DINZ eNews

DINZ eNews

17 June 2022

DINZ news in brief | Issue 88

Velvet exports could reach $200 million in the next decade | Venison still in recovery mode | Co-innovation the way forward for deer research | New improved VelTrak tags | Cantabrians needed to help educate regulators | Proposed NAIT levy hike trimmed back | New Zealand deer milk wins international dairy award | Trophy hunters return, along with potential risk | Thanks for talking to us

17 June 2022

Media release

Media release

8 June 2022

Deer industry wants to stay in the climate conversation

DINZ supports He Waka Eke Noa (HWEN) partners’ decision to submit their recommendations to the government. Concerns remain about potential for greenhouse gas (GHG) pricing to have a severe financial impact on some deer farms. Reducing emissions from food production, without threatening farmers’ viability is one of the most important issues for society to deal with.

8 June 2022

News release

News release

19 May 2022

Farmer gas challenges recognised by government ministers

The deer industry welcomes the government’s decision to fund the development of tools for farmers to use to reduce greenhouse gas emissions (GHG) from their livestock. “At present there is literally nothing many hill and high country farmers can do to reduce their emissions of methane and nitrous oxide short of reducing stock numbers. This in turn would reduce their ability to pay the emissions charges the government proposes to introduce in 2025,” says Deer Industry NZ (DINZ) chief executive Innes Moffat. The message taken on board by the minister and his colleagues is that farmers need tools to allow them to reduce GHG emissions and that the pathways to their development are sped up.

19 May 2022

News release

News release

19 May 2022

It’s all go in Sweden

Venison from Mountain River was showcased to Swedish retail and foodservice customers last week by distributor Menigo. Mountain River’s Swedish partner Gustaf Kugelberg reports the fair, held in the old town hall of central Swedish town Sundsvall, was “very good” and attended by 250 buyers. It’s all part of Mountain River Venison’s retail marketing activity in Sweden, supported by the DINZ Marketing Innovation Fund.

19 May 2022

News release

News release

19 May 2022

Deer Code gets pressure cooked!

Work on the new Deer Code of Welfare has shifted up a gear, with the National Animal Welfare Advisory Committee (NAWAC) aiming to have public consultation on the document completed ahead of the coming velvet season. NAWAC is aiming to have public consultation on the document completed ahead of the coming velvet season. The original Deer Code of Welfare was first issued in 2007 and apart from a couple of minor facelifts, has changed little since that time. A working group is reviewing the current draft.

19 May 2022

News release

News release

19 May 2022

Deer Farmers play a part in Otago’s fresh-water solution

The deer industry is contributing real data and knowledge about the sector into the Farmer/Grower Workstream of the Otago Regional Council (ORC)’s new Economic Work Programme (EWP). DINZ producer manager Lindsay Fung, environmental stewardship manager Sara Elmes and Tony Pearse are representing the deer industry in a new online forum – the ‘Otago Land and Water (LWRP) Economic Industry Advisory Group – which meets virtually every fortnight in the early phases of the programme.

19 May 2022

DINZ eNews

DINZ eNews

19 May 2022

DINZ news in brief | Issue 87

Confidence in market diversification holding the ship steady | Velvet sector growth, despite Covid challenges | New research on velvet and immunity published | Deer 101 on wintering deer for MPI and council officials | P2P post-programme update | Fixing emissions factors with DeerPRO | NAIT accreditation opens to applicants | 50 years of deer science – Research into finding lungworm early looking promising | New recipient of Korean OMD scholarship | 2022 Big Deer Tour | Wanted: additional director needed for OSPRI | Events

19 May 2022

Deer Industry News

Deer Industry News

21 April 2022

Deer Industry News Issue 113 April/May/June 2022

Venison in the UK: Alliance partners with NZ beer, Collective in clever UK venison promotion | Weaner Sales: Demand for stag weaners bounce back but caution in market for hinds | Immune Function: Initial research into velvet effect on immune function highlights good leads

21 April 2022

DINZ eNews

DINZ eNews

21 April 2022

DINZ says climate policy fight isn’t over

Deer Industry NZ (DINZ) says the battle to get a greenhouse gas (GHG) pricing system that’s fair to deer farmers is far from over. Its big concern is for those deer farmers who have little or no opportunity to plant trees to offset their emissions.

21 April 2022

DINZ eNews

DINZ eNews

21 April 2022

Post-PGP programme being developed to add to Advance Parties

As the Passion2Profit (P2P) co-funded PGP flows into its final six-months, different groups are reflecting on its progress and achievements. Two proposals are being put to the DINZ board: to continue Advance Parties (AP)/Rural Professional Workshops; and a new programme for deer farmers who have been unable to join an AP.

21 April 2022

DINZ eNews

DINZ eNews

21 April 2022

Venison entering upmarket retail in China

Over 6,000 retail packs of Alliance’s New Zealand venison have been sold in China since the start of the year, results that the co-operative and its in-market partner Grand Farm are “very pleased about,” according to Alliance Group’s marketing manager for Asia, Ethel Wong.

21 April 2022

DINZ eNews

DINZ eNews

21 April 2022

Rare Southern dry

A rare drought in Southland and Otago means deer farmers there are currently feeling the dry. Despite 40-70mm of “useful” rain arriving in two recent events to most deer farmers in the region, which has helped, it was not enough, says NZDFA Southland branch chair Bruce Allan.

21 April 2022

DINZ eNews

DINZ eNews

21 April 2022

DINZ news in brief | Issue 86

Spring peak schedule of $9.00/kg | Strong demand for velvet continued to the end of the season | DINZ, NZDFA and SAP nominations received | NAIT levy decision delayed | P2P – Eight picked for the 2022 Big Deer Tour | From the archives – the growth of male red deer for slaughter | Announcing Wormwise’s first manager, Ginny Dodunski

21 April 2022

News release

News release

18 March 2022

More deer voices needed on gas options

All deer farmers are being urged to make their voices heard about the farm greenhouse gas (GHG) pricing options developed by the He Waka Eke Noa (HWEN) partnership. The worst affected by the options are extensive hill- and high-country farms where tree planting is not possible because of climate and soil type, or because it is prohibited in a regional plan.

18 March 2022

News release

News release

18 March 2022

Schedule reflects processors’ optimism

The venison schedule is trending upwards, reflecting venison processors’ optimism. This week’s published schedule prices for AP stags range from $7.95-8.05 per kg – tracking in line with the five-year average for March of $8.04/kg.

18 March 2022

News release

News release

18 March 2022

Omicron disrupts venison processing

Venison processors and deer farmers are busy juggling the uncharted territory of the Omicron outbreak. All processors report staff absences due to illness or isolation with household members, which has reduced capacity and slowed processing of deer.

18 March 2022

News release

News release

18 March 2022

Looking for traction in the UK

Building and maintaining strong customer relationships for NZ venison in the UK has proved challenging for our marketers. Despite this history, they are using the superior cooking quality of NZ venison and our free range farming story to gain traction with chefs and consumers in a country where the ‘buy-local’ sentiment is strong.

18 March 2022

DINZ eNews

DINZ eNews

18 March 2022

DINZ news in brief | Issue 85

The HWEN options are better than the NZETS | China strategy making steady progress | Nominations sought for industry leadership | Covid clobbers conference | 50 years of deer science

18 March 2022

News release

News release

17 February 2022

Study highlights financial impact of GHG pricing

DINZ chief executive Innes Moffat says an independent case study has shown that greenhouse gas (GHG) pricing will have a big impact on deer farms that can’t plant trees to offset their emissions of methane and nitrous oxide.

17 February 2022

News release

News release

17 February 2022

Venison schedule graphs the recovery

Published schedule prices to venison farmers are continuing to increase and at around $7.80 a kilogram are their highest since Covid-19 first made its presence felt in early 2020.

17 February 2022

DINZ eNews

DINZ eNews

17 February 2022

DINZ news in brief | Issue 84

Velvet season closes on a strong note | KGC creates a real buzz for NZ velvet-based products in Taiwan | Helping deer farmers survive the regulatory machine | Interested in an industry governance role?

17 February 2022

News release

News release

17 February 2022

Three companies win support from 2022 Marketing Innovation Fund

Three venison companies have been selected for support in 2022, the second year of the DINZ Marketing Innovation Fund.

17 February 2022

Deer Industry News

Deer Industry News

16 February 2022

Deer Industry News Issue 112 February 2022/March 2022

- Reigniting food service in 2022 - Exporters Positive: venison sentiment takes an upturn as schedule perks up and demand starts to firm - He Waka Eke Noa: farmer feedback needed on two options for reducing emissions - Sire Sales: sales bounce back from last year's low; two sires top $100K; demand across the board

16 February 2022

News release

News release

16 December 2021

Venison market on the move

Average prices to venison producers have been holding well during December and are sitting about $1.50 a kilogram above where they were at the same time last year. Marketers and DINZ are increasingly confident that a long-awaited market recovery is underway and that returns to producers will continue to increase during 2022.

16 December 2021

News release

News release

16 December 2021

Brace yourself, a new normal lies ahead

In an end-of-year message, chief executive Innes Moffat, says 2021 will leave most of us with mixed emotions. Velvet prices have been great, venison prices have improved and will continue to recover. Looking ahead, he predicts thunder and lightning as the government seeks to rush through its environmental agenda.

16 December 2021

News release

News release

16 December 2021

DINZ advises caution under ‘Traffic lights’

The new Covid traffic light system creates a new level of complexity for anyone who has staff, for organisers of deer industry events and for DINZ itself. Moffat advises anyone organising a deer industry event take a cautious approach in order to protect family, staff and visitors.

16 December 2021

DINZ eNews

DINZ eNews

16 December 2021

DINZ news in brief | Issue 83

New environmental stewardship manager | VelTrak: thank you | Greenhouse gas consult coming | Big BERSA might help us and more

16 December 2021

Deer Industry News

Deer Industry News

1 December 2021

Deer Industry News Issue 111 December 2021/January 2022

Sustainable development model at Queenstown | Water Quality Research | Regenerative Agriculture | Profile of a Deer Industry Team Man

1 December 2021

News release

News release

18 November 2021

Venison recovery underway

The usual drop in farmer returns for venison that follows the spring chilled export season is expected to be much smaller this year. After reaching peak of around $7.10 a kg in October, average prices to deer farmers eased to around $6.90 a kg in mid-November and are expected to stay around that level at least until the end of the year.

18 November 2021

News release

News release

18 November 2021

Deer velvet enjoying strong demand

The 2021/22 deer velvet season has opened on a strong note, with prices up 10 to 15 per cent on last season’s close. This reflects strong underlying consumer demand, as well as the concern of overseas buyers to secure stock in advance of any possible Covid-related supply disruption.

18 November 2021

News release

News release

18 November 2021

Who will look after the deer if Covid arrives?

In the event of a Covid-19 outbreak on a farm it may only be a matter of hours before health officials decide where the infected people and any close contacts will be isolated. Planning for this worst-case scenario is extremely important.

18 November 2021

DINZ eNews

DINZ eNews

18 November 2021

DINZ News in Brief | Issue 82

Interested in becoming a board observer? | Full steam ahead on the farm | Study aims to unpick the chemistry of deer grazing behaviour | VelTrak VSD - don’t say ‘No’ if you don’t mean it

18 November 2021

News release

News release

18 October 2021

Velvet strikes a confident note

Velvet companies and Deer Industry NZ (DINZ) are reporting strong underlying demand for NZ deer velvet antler in major Asian markets. The season begins in October each year and runs through to late January.

18 October 2021

News release

News release

18 October 2021

Bright future predicted for farm-raised venison

Venison has a great long-term future, say venison marketers. They predict a steady recovery in prices to farmers in the next 12 months as traditional markets recover and new markets bear fruit.

18 October 2021

News release

News release

18 October 2021

Successor programme for P2P taking shape

As the deer industry’s seven-year Passion2Profit (P2P) programme enters its final year, design work for a successor programme is well advanced. P2P is the Primary Growth Partnership between DINZ and the Ministry for Primary Industries that launched in 2015.

18 October 2021

DINZ eNews

DINZ eNews

18 October 2021

DINZ news in brief | Issue 81

NZDFA branch chairs meet online| VelTrak use increasing as season gets underway | Great book published about 50 years of deer farming | Covid is coming, so be prepared and more!

18 October 2021

Deer Industry News

Deer Industry News

15 October 2021

Deer Industry News Issue 110 October/November 2021

Customers returning to restaurants in Europe | Hawke's Bay AP day | US retail activities | Next Generation stays farmside

15 October 2021

Media release

Media release

29 September 2021

Deer farming lobby builds on environmental strengths

Dr Lindsay Fung has been appointed producer manager at DINZ. He is currently the organisation’s environmental stewardship manager. DINZ is now advertising for a new environmental stewardship manager to replace Fung in his current role.

29 September 2021

News release

News release

17 September 2021

Venison demand improves, but shipping remains dire

The gradual opening up of Europe on the back of growing vaccination rates is good news for venison producers. There’s healthy demand for chilled venison from restaurants opening for the game season – the challenge for exporters is getting it there.

17 September 2021

News release

News release

17 September 2021

NZ venison on the menu in top restaurants in China

Marketers of New Zealand farm-raised venison are moving beyond the test kitchen and into leading restaurants in China. The aim is to find a profitable place for venison in the massive Chinese food market.

17 September 2021

DINZ eNews

DINZ eNews

17 September 2021

DINZ news in brief - 17 September 2021

VelTrak goes live | VelTrak quick-start guides on their way | New velvet grading chart | Getting to know your number and more.

17 September 2021

Deer Industry News

Deer Industry News

30 August 2021

Cervidae Oral article: Correction

The article “First triple active oral drench for deer” pertaining to the launch of Cervidae Oral, published in the Deer Industry News issue 109, August/September 2021, pp20-21 contained an error regarding the efficacy of Cervidae Oral against lungworm.

30 August 2021

News release

News release

20 August 2021

Buyers get hands-on with VelTrak scanners

Velvet buyers, agents and packhouses from across the country are now familiar with the hand-held scanners they will be using to scan VelTrak tagged deer velvet this season. Almost everyone who will be using a scanner in the 2021/22 season attended one of five buyer meetings held in July.

20 August 2021

News release

News release

20 August 2021

Spontaneous outbreak of enthusiasm in the shadow of Covid

It may have been a bitterly cold day in much of the country, but a good number of Kiwis dusted off their barbecues and cooked a venison-based meal on Saturday 7 August, the world’s first Venison BBQ day.

20 August 2021

DINZ eNews

DINZ eNews

20 August 2021

DINZ news in brief - 20 August 2021

Covid-19 Level 4 – it’s not business as usual | Need to go to town to pick up some drench? | Great vibes from up the coast | Reduce the risk of Covid transmission | Overseer still useful despite bad rap | Tony Pearse retiring and more...

20 August 2021

Deer Industry News

Deer Industry News

11 August 2021

Deer Industry News Issue 109 August/September 2021

Next Generation head to Queenstown, US Retail Venison, Velvet Workshop, Tech Expo Report and more...

11 August 2021

News release

News release

16 July 2021

Welcome expected for new deer drench

The first triple-active oral drench for deer, Cervidae Oral, will be available from rural supplies stores and vets from 1 September. The three actives in the drench are mixed in ratios tailored specifically to deer. The new drench has a 28-day withholding period.

16 July 2021

News release

News release

16 July 2021

Farmed venison scores at major international competition

Grass-fed venison ribs and venison cubes marketed by Silver Fern Farms have been selected as two of the Top 50 products entered in the 17th SIAL China Innovation Competition – one of the world’s biggest food and beverage events.

16 July 2021

News release

News release

16 July 2021

Changing of the Deer QA guard

DINZ has appointed a leading specialist in farm animal welfare, Dr Rob Gregory, as general manager, quality assurance. He replaces John ‘JT’ Tacon who is retiring after working for deer industry organisations for more than 30 years.

16 July 2021

DINZ eNews

DINZ eNews

16 July 2021

DINZ news in brief - 16 July 2021

DINZ to submit on proposals for freshwater farm plans | Mandy Bell new DINZ director | NZ Venison BBQ day 7 August | Pamu deer milk nutritional study | Know your number? | VelTrak: don't keep putting it off! | Nitrous oxide is a hell of a gas | Restaurant closures hit UK deer farms too | Taupo deer farmer takes out Rabobank award and more...

16 July 2021

News release

News release

16 July 2021

Venison farmers taking a long-term view

Prices for venison animals during the traditional spring game season are expected to be only a little more than last year. However the contracts on offer from marketers this year are likely to be for larger volumes than in 2020, which means average prices across all venison animals may be higher.

16 July 2021

Deer Industry News

Deer Industry News

18 June 2021

Deer Industry News Issue 108 June/July 2021

Conference coverage: Find out what was covered at the 2021 Deer Industry conference. Virtual Tours: Keeping key Korean customers in touch with Kiwi farmers and science. Canterbury floods: Deer farmers region face huge stock recovery challenges and more...

18 June 2021

News release

News release

31 May 2021

Venison marketers unleash creative energy

“It is hellishingly frustrating to be a producer of one of the world’s most healthy and delicious proteins and to lose nearly all your top-end customers overnight. It’s never happened before. Not for New Zealand food producers anyway.”

31 May 2021

DINZ eNews

DINZ eNews

31 May 2021

DINZ news in brief - 31 May 2021

Award winner breaks the mould | Great conference in the south | STOP PRESS: South Canterbury deer farmers hit by storm | Registered for VelTrak yet? | Know your GHG number; it matters | Need help with your winter grazing plan or GHG numbers? | Damien O’Connor on hot topics and more...

31 May 2021

News release

News release

31 May 2021

Global food brands seeking farmers with a plan

Global food brands, consumers and investors are looking for the proof that food producers are acting in an ethical and environmentally sustainable manner. New Zealand farmers agree that one of the best way to do this is for each farmer to have a robust farm environmental plan.

31 May 2021

News release

News release

26 May 2021

Hawkes Bay farmers win premier deer environmental award

The winners of the 2021 Elworthy Award, the premier environmental accolade for deer farmers, are Grant and Sally Charteris, Forest Road Farm, Central Hawkes Bay. The award was presented at the Deer Industry Conference in Invercargill earlier this month.

26 May 2021

Media release

Media release

1 April 2021

VelTrak™ coming down the line

Good progress is being made with the roll-out of VelTrak™, the new electronic track and trace system that is being introduced in readiness for the 2021/22 velvet season. Registration for vets and buyers opens on 6 April and for farmers on 3 May.

1 April 2021

DINZ eNews

DINZ eNews

29 March 2021

DINZ news in brief - March 2021

Central Hawke's Bay deer farmers Evan and Linda Potter win the National Ballance Farm Environment Award (BFEA) | DINZ submitting on Climate Change Report on behalf of deer sector | Velvet boots on the ground in China

29 March 2021

News release

News release

22 July 2020

It’s official: progeny of high-CARLA sires can grow better

Deer farmers have a new tool available in their fight against one of their industry’s most productivity-sapping animal health challenges: internal parasites.