New Zealand’s five major venison marketing companies, the New Zealand Deer Farmers’ Association and Deer Industry New Zealand (DINZ) have agreed to work together to transform the New Zealand venison industry. This 7-year programme has been named Passion2Profit (P2P) to reflect the passion of the industry for deer and venison, as well as the need for all involved in the industry to make greater profits.

Maturing as an industry has brought with it a range of benefits. It also carries with it the risk of losing the urge to change and adapt. In short:

- We need to generate more profit to attract new investment;

- We need to attract new farmers to take the place of the pioneers

- Other land use options are improving their production efficiency more quickly than we are.

- Competing venison producers in Europe are copying our techniques and chasing our markets.

To address these issues, we need to do two things: improve our marketing, so that the industry earns more from each kilo of venison it produces and increase farm productivity, so that venison production is more profitable, resilient and competitive as a land use.

The way we are doing this is through our Passion2Profit strategy.

P2P has been a successful 7 year project co-funded together with MPI. Co-funding and the programme finished in September 2022. The resources continue to be available and some programmes continue under programmes to improve practice change and capability. Marketing programmes are continuing as apart of a range of ongoing and new marketing initiatives. The initial P2P project was made up of two interlinked projects:

- Marketing premium venison

- Market-led production

These projects aimed to correct the mismatch between venison production and demand in traditional markets, while progressively developing new markets that demand quality venison at chilled prices all year round.

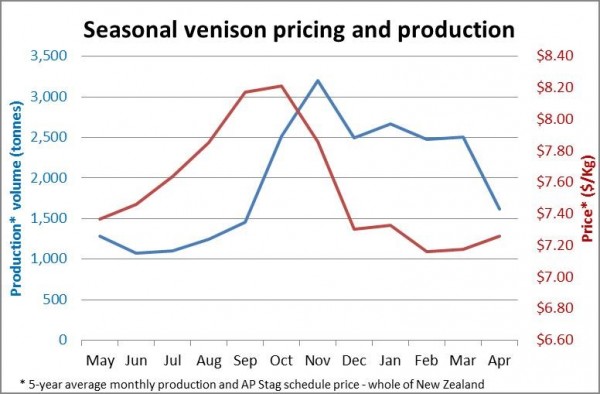

This graph clearly shows the mismatch between demand for venison from traditional markets, as reflected in the prices paid to farmers, and production:

- The profitability of the New Zealand deer industry needs to improve so it is more competitive with alternative land uses.

- The low profitability of venison farming is largely because it remains over-reliant on the commodity game meat market in continental Europe. This market has a narrow window of demand in the northern autumn/early winter when chilled venison cuts have an average value 20-30% greater than the rest of the year.

- On-farm, many producers have been unable to produce young venison in the optimum weight range for this market window. As a result, much New Zealand venison is frozen and stored for many months before being traded as an undifferentiated commodity into this market.

- In recent years, returns to farmers have declined as a result of subdued consumer demand in Europe, growing competition from other game meats and the weakening Euro. In response, many farmers have converted to more profitable farming options and the national deer herd has fallen from its peak of 1.7 million deer to under 1 million.

- Without change, the deer industry will continue to shrink and with it, the ability to fund research, market development and other services needed to ensure its long-term viability. This will be a major loss. Not just for those who are committed to deer farming, but for Brand New Zealand and for those other farmers for whom deer are a potential avenue for diversification.

- The changes needed are unlikely to be achieved through a business-as-usual approach with small changes made each year. A game-changing investment is needed to allow many initiatives to be implemented simultaneously – the only way they are likely to be successful. Only with co-funding from the government’s PGP fund was such a strategy possible.

- P2P aimed to increase the amount of NZ venison sold in chilled form, year round, at higher prices. This will diversify the consumer base for venison, thereby spreading market risk, extend the consumption period and generate greater sales of higher value chilled venison.

- The five largest venison marketing companies – Alliance Group, Silver Fern Farms, Duncan and Co, Mountain River Venison and Firstlight Foods – will work together to design a collaborative marketing programme. This will go far beyond the scope of existing promotion programmes for NZ venison. It will involve the development of common brand values and positioning by these companies for their use in new markets and new market niches.

- A single set of product and production quality standards will also be developed to underpin the positioning of NZ venison in both developed and developing markets.

- Marketers will work together to open new markets where NZ venison will be positioned as a luxury, non-seasonal meat.

- The first stage will be to uncover opportunities in new markets such as mainland China. Venison is relatively unknown in Chinese cuisine, but the creation of demand for premium venison products in a country as large as China has the potential to increase year-round demand and reduce reliance on the European game meat market.

- The second stage will be to test New Zealand’s ability to position the finest venison as a new, exotic, non-seasonal grilling concept in one or two smaller markets in Europe. The products will be positioned to be distinct from ‘game’ meats.

Project 1

Expansion of the collaborative Summer marketing programme in the Netherlands to increase sales outside of the traditional European game season. Identify other markets that can benefit from collaborative development. Aiming to have three or four new non-seasonal markets taking 1,200 tonnes (CWE) of venison by year 7.

Project 2

Implement a collaborative marketing programme in China, if it is commercially feasible to do so. Aiming to have new markets able to demand up to 2,500 tonnes (CWE) of venison by year 7.

Project 3

Implement national on-farm quality assurance programmes via venison processors, in step with the red meat farm-assurance programme. Aim to have national adoption of the QA Standards by year 7 across all venison processing companies.

The Cervena Benelux trial

The trial focuses on introducing Cervena Venison to Dutch and Belgian Foodservice channels, is now into its 3rd year.

The long-term aim of this project is to sell more chilled venison all year round and specifically to have available 1200T CWE destined for non-traditional markets.

In 2016, 3 exporting companies: Firstlight, Silver Fern Farms and Alliance worked with their in-market partner wholesalers, Hanos, Sligro and Metro to promote Cervena venison during spring- summer. In 2017, Duncan NZ will join the trial in 2017.

Exporting companies agreed on a summer positioning promoting the suitability of Cervena as a lighter summer eating option to chefs and agreed to use messaging and imagery that was consistent with this positioning.

Promotional activities focus on introducing to Chefs and to a smaller extent consumers, to what Cervena is, its quality credentials and its suitability for summer eating.

Click here to see some of the activities which have been carried out.

www.hap-en-tap.be/cervena-het-meest-malse-en-magere-vlees-van-de-wereld/

www.kriskookt.be/cervena-zomer-hert-nieuw-zeeland/

China Market Development Project

The five marketing companies agree to examine opportunities for New Zealand venison in Mainland China. Venison is not a commonly used meat in most mainstream Chinese cuisine styles, but the healthy attributes of venison and New Zealand's reputation as a producer of fine food should provide opportunities to supply niche markets. The companies have sponsored market research asking for key purchase motivations of Chinese consumers and chefs, and conducted market development work with importers and Chinese chefs in theTier-One Cities on the mainland.

Germany Summer Marketing Trial

Silver Fern Farms and Alliance will lead the industry approach to marketing Cervena venison in Germany as a summer protein option in 2017. Specialist food service distribution companies are partnering with the New Zealand industry to introduce Cervena Venison as a differentiated protein from traditional game season products as an ideal option for lighter summer style dishes and grilling items.

For coverage of the project click here >>

- P2P developed systems to help farmers respond to current and future market demands.

- Leading farmers have successfully integrated the best scientific knowledge on deer feeding, animal health, and genetics into their farm systems. This enables them to profit from delivering deer in the weight range and at the time that the traditional market demands. P2P enabled more farmers to deploy these technologies successfully.

- P2P packaged technologies into solutions that are convenient for farmers to apply. These were delivered to farmers in new and innovative ways. Advance Parties[1], are one example of how this worked.

- To assist in the ‘packaging’ and delivery of solutions, technology was divided into four main categories – feeding, genetics and animal health, and environment. A champion and a reference group was be appointed for each.

[1] A 3-year trial of Advance Parties 2014-2016 was co-funded by DINZ and the MPI Sustainable Farming Fund

- Benchmarking: An expert working group of large-scale farmers was formed as part of Advance Parties to develop productivity benchmarks for commercial farmers. This allows meaningful comparisons to be made between farms.

- Expertise development: identifying farm consultants, veterinarians and other specialists with expertise in deer and where necessary filling regional gaps. Special training and workshops developed.

- Knowledge wholesaling: Systems have been set up to enable science and practical knowledge to be better packaged and disseminated to farmers and those who advise them.

- Tailored farmer communications: Individual farmers are provided with information that is relevant to the performance of their operation. For example, how their farm performs relative to peers in average slaughter date or average carcase weight.

- P2P cost $16 million over seven years. Of this, half was funded by the government’s Primary Growth Partnership (PGP) and half funded by the deer industry, using funds derived from producer and exporter levies.

- P2P expenditure fell into six subprojects:

Marketing premium venison: $8.2 million over 7 years

a. Confirming market requirements: $1 m over years one and two

b. Collaborative marketing: trialling and establishing distribution via: $5.1 m over 7 years

c. Developing and applying industry standards: $1.6 m over 7 years

Market-led production: $7.8 million over 7 years

d. Overall project management: $0.8 million over 7 years

e. Accelerating industry change through the development and deployment of new farmer engagement strategies such as Advance Parties: $4.1 m over 7 years

f. Packaging of the best information on genetics, feeding and deer health technology to create on-farm solutions: $2.9 m over 7 years.

The P2P programme benefited deer farmers, marketers, customers, the wider farming industry, the economy and the New Zealand brand.

| Venison farmers | Industry bodies | Processors / marketers | Customers / market | New Zealand | |

| Improved and less volatile profitability | * | * | * | ||

| Improved environmental sustainability | * | * | * | * | * |

| Increased returns flow to suppliers, rural communities and the New Zealand economy | * | ||||

| Template for collaboration | * | * | * | ||

| Enhancing the value of New Zealand’s brand | * | * | |||

| Optimised land use | * | * | |||

| A new practice change model for the primary sector | * | * | * | ||

| Diversified agricultural portfolio | * |

DINZ estimates that P2P would increase export revenue by $56 million and net industry earnings by $34 m a year. Year 7 revenues will be $75 m higher than they would have been under a ‘do-nothing’ scenario, in which the industry continues to shrink. These figures assume that the farmers of 50% of the national deer herd adopt new practices and that new markets for venison have been created by year 7. Disruption caused by Covid-19 made it harder to reach these targets, though a positive net benefit to New Zealand was achieved.

These benefits include:

In the market

Selling a larger volume of venison and getting higher average prices for it:

- Because more prime animals will be produced in time for peak spring demand from the traditional market, chilled venison exports in the European game season will increase from $32 m to $52 m a year

- Non-seasonal exports of chilled venison, catering for new demand from alternative markets, will increase from $25 to $35 m a year

- An increase in total venison output will increase frozen venison revenues by $26 million a year.

On the farm

By increasing revenue growth (as above) and making the following on-farm efficiency improvements:

- Survival to sale rates will increase to 76%, from the industry average of 72%

- Growth rates and carcase size at slaughter will increase by 4 kg by year 7, resulting in a 6% feed saving of per kg venison produced. The average age at slaughter will reduce by 8%, making more deer available during the chilled season.

- Processing efficiency will increase by 7% per kg of venison, as a result of heavier average carcase weights

- The average value of a deer carcase will increase by 1%, as a result of increasing loin and leg muscle yield

All benefits of P2P flow to New Zealand farmers, venison processing and marketing company staff and shareholders (the majority of whom are farmers).

These benefits continue after the PGP programme has finished. Genetic improvements are permanent, as will higher market returns due to new demand and increased collaboration between farmers and their marketing companies.

The Net Present Value (NPV) of P2P (benefits less costs) to the deer industry EBIT over 20 years is $520 million assuming a maximum of 50% adoption and ongoing costs beyond year 7 of 50% of P2P levels.

The Passion2Profit programme aimed to grow and capture the full value available to New Zealand by collaboratively positioning farm-raised venison in new markets as a premium non-seasonal meat, and by better aligning supply with demand.

A range of activities were undertaken to address these aims. Progress and activity are reported quarterly to the funders, the quarterly reports are public documents and are available here:

Jan - Mar 2022 Quarterly Report

Oct - Dec 2021 Quarterly Report

July - Sept 2021 Quarterly Report

Apr - June 2021 Quarterly Report

Jan - Mar 2021 Quarterly Report

Oct - Dec 2020 Quarterly Report

July - Sept 2020 Quarterly Report

Apr - June 2020 Quarterly Report

Jan - Mar 2020 Quarterly Report

Oct - Dec 2019 Quarterly Report

July - Sept 2019 Quarterly Report

Apr - June 2019 Quarterly Report

Jan - Mar 2019 Quarterly Report

Oct - Dec 2018 Quarterly Report

Jul - Sep 2018 Quarterly Report

Apr - June 2018 Quarterly Report

Jan - Mar 2018 Quarterly Report

Oct - Dec 2017 Quarterly Report

Jul - Sept 2017 Quarterly Report

Apr - Jun 2017 Quarterly Report

Jan - Mar 2017 Quarterly Report

Oct - Dec 2016 Quarterly Report

Jul - Sept 2016 Quarterly Report

Apr - Jun 2016 Quarterly Report

Jan - Mar 2016 Quarterly Report

Oct - Dec 2015 Quarterly Report

P2P was governed by a Programme Steering Group (PSG) made up of a representative from MPI, two from DINZ, one representative of the venison marketing companies and an independent chair.

The steering group:

- Provided programme governance and decision making

- Provided strategic insight

- Ensured the programme aligns to industry and individual co-investor needs and expectations

- Managed risks.

The PSG was supported by two working groups:

- Marketing working group

Composed of a representative from each of the marketing co-investors (Alliance Group, Silver Fern Farms, Firstlight Foods, Mountain River Venison and Duncan & Co) as well as the P2P Marketing Premium Venison programme manager. - Passion2Profit advisory group

Composed of industry participants who have expertise in relevant fields (including genetics, animal health, feeding, information systems and Advance Parties), two from the NZDFA as well as the P2P Market Led-Production programme manager.

Progress Report on the Primary Growth Partnership Passion2Profit Programme.

Sapere Research Group

The objective of this progress review is to provide the co-investors in the PGP with an independent assessment of how the programme is tracking towards its goals.

The full report is available and can be downloaded on the MPI website >>

Extract from Executive Summary:

Our analysis of the P2P PGP’s value drivers shows that most of the value was expected to come from increasing the volume of venison production. Prices were assumed to be static. The volume increase was to occur through a rise in hind herd numbers, an increase in average carcass weight, an increase in survival to slaughter and an increase in the average loin size driven by P2P initiatives.

Analysis of the P2P PGP’s strategy to reduce the proportion of production that was frozen, and switch 5 percent of this production to chilled, did not appear to be a significant value driver. This was because the increase in value from chilled exports was nearly offset by the decrease in frozen revenue.

While the direct returns of shifting production into chilled from frozen may not be great, the level of cooperation in the venison market achieved by the P2P PGP exceeds other sectors in the meat industry. The ‘marketing premium venison’ arm of the PGP has resulted in market development for Cervena in the Benelux in particular that would have been much more difficult, if not impossible, without the PGP. However, the tight supply of venison has made it most unlikely the PGP will achieve its ambitious 2022 market targets.

The market led production arm of the P2P PGP has made real progress in a number of areas. The Advance Parties initiative to drive practice change and technology adoption has been particularly successful. Moreover in the last year and a half the APs have been widening the spread of knowledge from their activities by involvement in the regional workshops designed to reach out to other deer farmers.

Analysis suggests that genetics could fundamentally grow the deer sector’s productivity and there has been encouraging recent research by AgResearch into venison heritability. We see value in devoting more resources to unlocking this potential. But it has proved difficult. It may be wise to initially investigate why there has been such a gulf between users and nonusers and why non-users claim to want to know more but when it’s offered don’t seem motivated to attend workshops.

Access to experts or influential advisers, strategic feeding and initiatives aimed at improving animal health are important. Strategic feeding in particular has been a clear benefit to many AP members and will be driving material improvements in production as a direct result of this PGP. Because it drives production volume and quality it may merit greater funding than the 4 percent of the P2P 2017/18 budget that it has been allocated. Improving access to experts, regional workshops and encouraging animal health planning are building momentum as they have all started in earnest only in the last 18 months.

Overall, the governance and management of the P2P PGP are very capable and focused on results. The P2P has achieved its Output Logic Model short term outcomes for the period from the PGP’s beginning in mid-2015 to 2018. We do not believe that the P2P can claim benefits or losses from all changes in deer numbers as was implicit in the 2014 Business Plan. But an estimate of incremental revenue from the P2P PGP derived from changed feeding and animal health practices amongst AP members only gives an amount of $8.2 million. This is nearly double the P2P PGP’s aggregate expenditure as at the end of 2017. This suggests that the P2P could well be paying back its cash costs already.

The profitability of deer farming varies greatly from farm to farm, even between farms operating similar stocking policies in the same district. Lower profitability is usually the end result of lower productivity.

The Passion2Profit (P2P) strategy helped farmers improve their farming systems so they become more profitable and so the deer industry as a whole is more competitive with alternative land uses.

Leading farmers have successfully integrated the best scientific knowledge on deer feeding, animal health, and genetics into their farm systems. These farmers not only produce more venison and velvet per hectare, they also produce more young deer in the right weight range when it is wanted by the market, therefore capturing premium prices.

P2P used this knowledge, as well as that of deer scientists, vets and management specialists, in a range of initiatives. In this section of the Deer Hub you will find useful tools, many of them developed as part of the P2P programme, for increasing the profitability of your deer farm.

More resources

A growing library of convenient DINZ Deer Fact sheets on ways to boost deer farm productivity and profit is being published as part of the P2P programme. To download your own copies, click on the below links.

- Best practice mating management >>

- Best practice management of pregnant hinds >>

- Best practice weaning management >>

- Growing weaners for the spring venison market >>

- Setting reproduction targets >>

Feed calculation tools

Check out the tools in the Feeding section of this website:

- Feed calculation tools: For measuring and managing feed for deer.

- Forage rotation planner: If a paddock needs replacing, use this forage planner as a guide to the options that are available, click here >>