Apr 30, 2025

A new market research report from Mintel, released in early March and titled “The Future of Meat and Poultry,” has unearthed some interesting findings across three regions: Europe, the Middle East and Africa (EMEA); Asia-Pacific (APAC); and the Americas.

Broadly speaking, the shift to quality over quantity continues, with premium meat product launches growing despite the less-than-ideal economic environment for premium products. In addition, some companies are offering bone-in and whole cuts to try and emphasise the minimal processing input, which is fast becoming a consumer concern.

The research outlines how things might change for the meat industry over the next 2-5 years, with findings that suggest:

- Less-is-more, less-is better attitudes to meat will continue as single occupant households grow in number, particularly in Asia.

- Protein remains a key consideration for consumers.

- Antibiotic-free and hormone-free claims from companies/brands will become increasingly relevant as different jurisdictions have different regulations or requirements.

- Quick-cook (aka convenience) products will continue their rise, but how that is balanced against an increasing focus on less processing will be a challenge.

- Offals will play a part in health-focused products as companies look to maximise use and minimise waste.

Also singled out as a potential segment for growth was sports nutrition and recovery, with healthy meat snacks offering a quick and easy way to refuel and aid muscle repair and recovery. Like with most prevailing attitudes, the more natural and sustainable the product is, the greater its chance of appeal, particularly with younger consumer segments such as Gen Z.

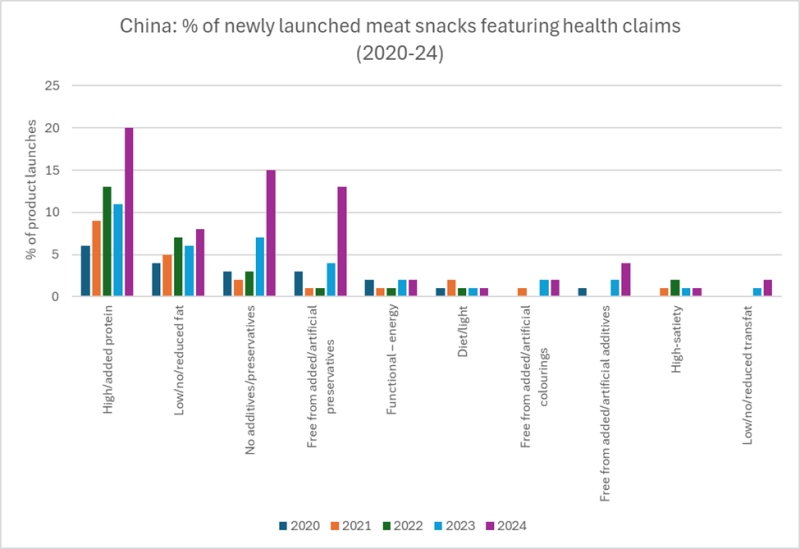

Health and nutrition key in China

Another piece of research released recently, titled “Meat snacks are winning over Chinese consumers with a healthy edge,” shines a light on many of the global meat trends previously mentioned, including the growing demand for protein and a desire for healthy processing (dried, non-fried, and steamed are common terms in China). The report also mentions the popularity of healthy meat snacks among parents looking for nutritional supplementation for their children.

And staying in China, at the other end of the age spectrum, recent research from New Zealand Trade and Enterprise (NZTE) highlighted the potential for China’s silver economy.

One in every four seniors globally is Chinese, according to the report, and presents opportunities as the country’s demography shifts.

An area where venison could play a role is specifically tailored nutrition. Protein deficiency and malnutrition is a concern for Chinese seniors due to traditional diets, so venison, a high protein meat that doesn’t require large portions, could play a role if products can be developed.

Demographic trends in China can vary considerably by province or region, and when combined with salaries and/or household income, the three regions that stand out for targeting are Beijing and Dongbei, or northeastern China; Shanghai and the Yangtze Delta cities, or the coastal cities; and the cities of the fast-developing Sichuan Basin in western China, namely Chongqing and Chengdu.

The growing Chinese senior market also has positive implications for velvet, as traditional Chinese culture, including medicine, is promoted domestically, and we shift away from the commodity trade and into more value-added products through partnering with established companies like Beijing Tong Ren Tang, who DINZ signed an MOU with last year.

Around the world, we are seeing some clear trends firm their importance: quality over quantity, a focus on health and wellness, and a preference for natural or less processed products. With the superior nutritional profile of venison and our top-shelf farming practices, these areas are ripe for exploration of how to drive further value for our producers and the industry.